The 5-Second Trick For Mileagewise - Reconstructing Mileage Logs

The 5-Second Trick For Mileagewise - Reconstructing Mileage Logs

Blog Article

3 Simple Techniques For Mileagewise - Reconstructing Mileage Logs

Table of Contents7 Easy Facts About Mileagewise - Reconstructing Mileage Logs DescribedMileagewise - Reconstructing Mileage Logs Fundamentals ExplainedMileagewise - Reconstructing Mileage Logs Things To Know Before You BuyNot known Details About Mileagewise - Reconstructing Mileage Logs The Basic Principles Of Mileagewise - Reconstructing Mileage Logs Mileagewise - Reconstructing Mileage Logs Can Be Fun For AnyoneThe Definitive Guide to Mileagewise - Reconstructing Mileage Logs

Timeero's Quickest Distance feature suggests the shortest driving route to your workers' location. This function boosts efficiency and adds to set you back savings, making it a crucial possession for services with a mobile workforce. Timeero's Suggested Route function additionally boosts liability and effectiveness. Employees can contrast the recommended path with the actual path taken.Such a strategy to reporting and conformity streamlines the commonly intricate task of managing gas mileage costs. There are several benefits linked with using Timeero to keep an eye on gas mileage. Allow's take a look at a few of the application's most significant attributes. With a trusted gas mileage monitoring device, like Timeero there is no requirement to stress about mistakenly omitting a date or piece of details on timesheets when tax time comes.

The Main Principles Of Mileagewise - Reconstructing Mileage Logs

With these tools being used, there will certainly be no under-the-radar detours to increase your compensation prices. Timestamps can be located on each mileage entry, increasing reliability. These added verification steps will keep the internal revenue service from having a reason to object your mileage records. With exact mileage tracking modern technology, your workers don't need to make rough mileage estimates and even fret about mileage expenditure monitoring.

If a staff member drove 20,000 miles and 10,000 miles are business-related, you can create off 50% of all auto expenses (mileage log for taxes). You will certainly require to continue tracking mileage for work even if you're utilizing the real cost approach. Keeping gas mileage documents is the only means to different company and personal miles and provide the proof to the IRS

Most mileage trackers let you log your trips manually while computing the distance and reimbursement quantities for you. Many likewise come with real-time journey tracking - you require to begin the app at the beginning of your trip and quit it when you reach your last destination. These applications log your start and end addresses, and time stamps, along with the total range and reimbursement quantity.

Some Known Details About Mileagewise - Reconstructing Mileage Logs

This consists of costs such as fuel, maintenance, insurance coverage, and the automobile's depreciation. For these prices to be thought about deductible, the automobile must be used for service purposes.

The Buzz on Mileagewise - Reconstructing Mileage Logs

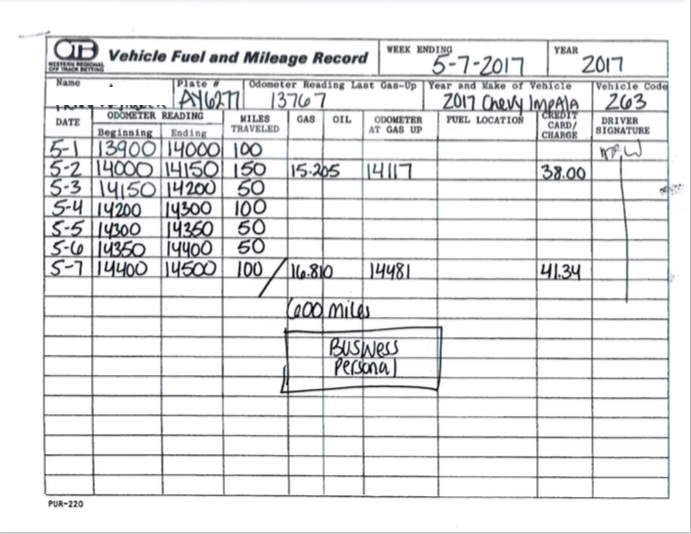

In in between, diligently track all your company journeys noting down the starting and finishing analyses. For each trip, record the location and service objective.

This includes the total company gas mileage and total mileage build-up for the year (business + personal), trip's date, location, and function. It's vital to tape-record tasks immediately and maintain a contemporaneous driving log outlining day, miles driven, and service objective. Here's just how you can boost record-keeping for audit objectives: Start with making sure a thorough mileage log for all business-related travel.

The Single Strategy To Use For Mileagewise - Reconstructing Mileage Logs

The real expenses technique is an alternate to the conventional gas mileage rate method. As opposed to determining your deduction based on a predetermined price per mile, the real expenditures technique enables you to subtract the actual prices related to using your car for service functions - mileage tracker. These prices consist of gas, maintenance, repairs, insurance policy, depreciation, and various other relevant expenses

Nevertheless, those with considerable vehicle-related expenses or one-of-a-kind problems may benefit from the actual costs technique. Please note electing S-corp standing can change this calculation. Ultimately, your chosen approach needs to straighten with your particular economic goals and tax scenario. The Criterion Mileage Price is a procedure issued annually by the internal revenue service to establish the insurance deductible costs of running an auto for company.

5 Simple Techniques For Mileagewise - Reconstructing Mileage Logs

(https://www.gaiaonline.com/profiles/mi1eagewise/46919649/)Compute your overall organization miles by utilizing your beginning and end odometer readings, and your tape-recorded organization miles. Properly tracking your exact mileage for business journeys aids in corroborating your tax reduction, especially if you decide for the Requirement Mileage method.

Keeping track of your mileage by hand can call for persistance, but keep in mind, it might save you money on your taxes. Tape-record the go right here complete mileage driven.

5 Simple Techniques For Mileagewise - Reconstructing Mileage Logs

And currently virtually everybody makes use of GPS to obtain about. That implies almost everybody can be tracked as they go regarding their service.

Report this page